Operating Partner Salary Report Across Private Equity Firms

November 28, 2024

At A Glance

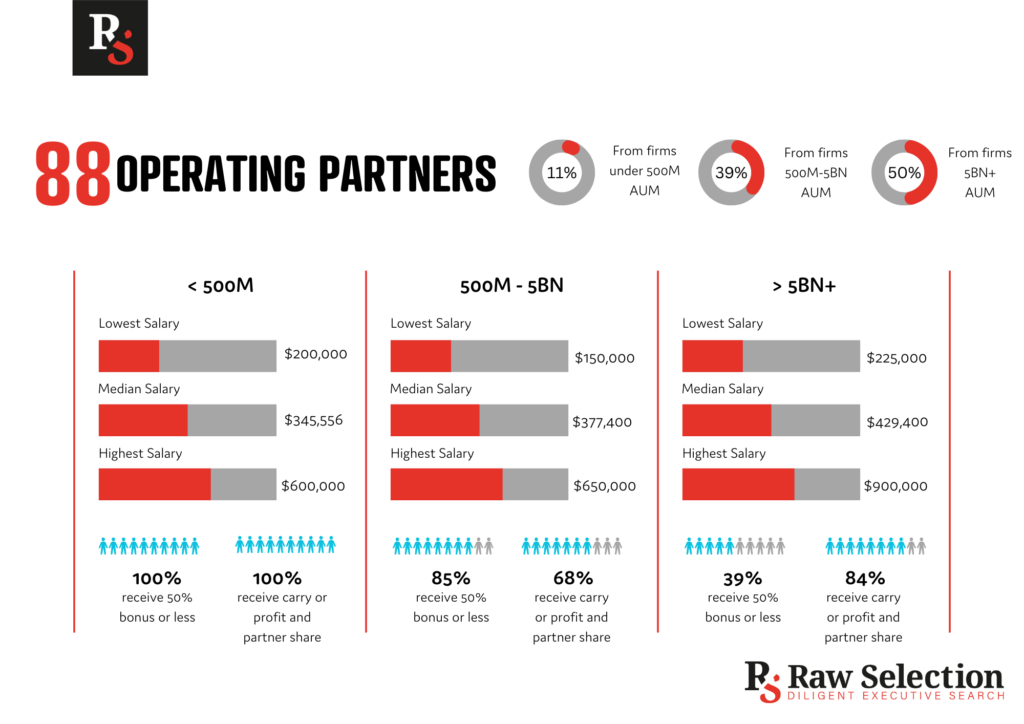

Operating Partners play a critical role in driving operational improvements within portfolio companies in the Private Equity space. Understanding their compensation is key to navigating recruitment and retaining top-tier talent for your portfolio companies. Here’s a breakdown of the operating partner compensation data based on assets under management (AUM), as outlined by recent surveys.

Get in Touch

Raw Selection favors a meticulous approach to talent research. Our process for selecting the right talent means we can boast a 100% success rate for all our retained and engaged C-Suite clients, with 96% of placed candidates still in their roles after 12 months.

If you are looking for new talent, contact us now.